Founding a startup can be an exciting but challenging journey. You may not need investor funding to launch your startup, but you will likely need such funding to grow or scale your business.

However, many founders struggle to find investors, get their attention and obtain funding. This is especially true for founders who are unfamiliar with the process.

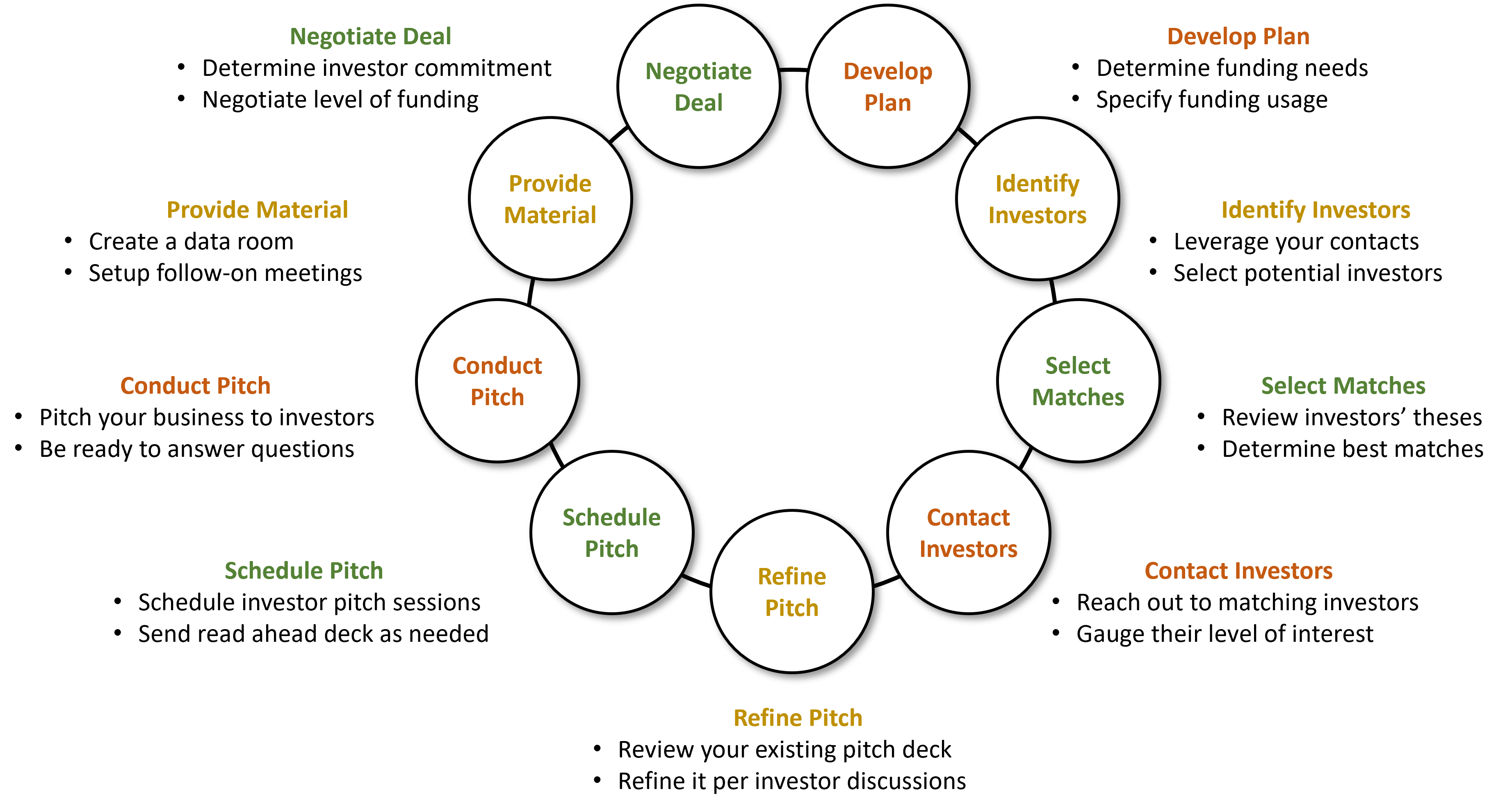

Here are the nine key steps to attract investors and raise funds.

Keep in mind that securing funding is not just about pitching your business to investors. It's also about building relationships and demonstrating traction.

1. Determine Your Funding Plan

Before you start looking for investors, it's important to clarify the vision for your startup and the important milestones you expect to achieve. It’s also important to understand how much funding you will need to reach the milestones, and how you will apply the funds accordingly.

Having a funding plan shows investors that you are serious about your vision and direction. It also helps you focus your search on investors who are a good match for your startup.

- Identify the milestones for your startup (e.g., number of customers, amount of sales)

- Figure out how much funding is needed to achieve the milestones

- Clarify how the funds will be used (e.g., hiring sales staff, product development)

- Determine a schedule for when the funds are needed

- Highlight the results of your effort in your pitch deck

Note that although not critical, you may want to estimate the pre-money valuation of your startup. This could help to put your funding request in perspective.

Tip: Don’t raise money before you’re ready to accept it. Raising money too early could cause you to spend it prematurely and can significantly dilute your equity.

2. Identify the Investors

You should leverage your personal and professional contacts to identify potential investors. Research different types of investors, such as angel investors, investment groups and crowdfunding platforms.

- Check your network of family, friends and associates

- Attend startup events, meetups and conferences

- Talk to other founders and ask about their funding experiences

- Connect with investors through social media such as LinkedIn

- Find investors on platforms like AngelList and Gust

- Check news and information sources like TechCrunch and Crunchbase

Tip: It will be critical for your success to be part of the startup ecosystem, including individual and institutional investors, from corporations, academia, government and local community organizations.

3. Select the Best Matches

Research the investors you’ve identified to determine which ones best match your startup. This may require a little extra effort, as investors don’t use a standard set of criteria to indicate their preferences.

- Review the funding stages in which they invest (e.g., pre-seed, seed)

- Review their investment criteria (thesis) for matches to your startup

- Business type: (e.g., B2B, B2C)

- Business model (e.g., SaaS, marketplace, subscription)

- Sector/Industry (e.g., healthcare, financial, retail)

- Geography (e.g., local, regional, national)

- Review their investment portfolio of current and previous deals

- Look for contact information (e.g., email, website, social media)

Ideally, this step should yield a handful of investors you can contact to determine their interest.

4. Contact the investors

Use your network to secure warm introductions to potential investors. Ask your advisors, mentors, and other investors for referrals.

If you’re relatively new to the startup ecosystem, try making a cold contact. Many investors, me included, welcome cold contacts because we’re actively seeking startup opportunities.

- Use the contact information you found to reach out to investors

- Personalize your message from what you’ve learned about the investor

- Be clear and concise in your communication

- Include your elevator pitch or executive summary, as appropriate

- Explain how your startup is a match to the investor’s thesis

- Include a call to action for a short initial meeting (15-20 minutes)

Note that it may take a few attempts to make contact before you get a response. Investors, like anybody else, can get busy.

Be persistent but respectful. If you don’t get a response from an investor after a few attempts, it may be time to move on.

5. Develop/Refine Your Pitch

Develop or refine your existing materials into a compelling pitch, based on your initial investor interactions. Be sure to include the 10 most common topics that are addressed in pitch decks.

Also, present your pitch in the form of a story. This will be more interesting to investors rather than simply reciting facts about your startup.

Your story could be the experience that led you to start the business. Or it could be about the journey of a particular customer. Use whatever works to engage your audience in a conversation.

- Consider three types of pitch decks:

- Short deck for pitch competitions (usually 3-5 minutes, 7-10 slides)

- Medium size deck for presenting to interested investors (10-12 slides)

- Longer deck for sharing with investors who have requested it (12-20 slides)

- Make sure your pitch is clear, concise and coherent

- Tailor your narrative as needed if an investor is most interested in particular topics

Think of the investors as your customers and you’re “selling” them the opportunity to participate in a wonderful startup with significant growth potential.

You must be able to communicate the value of your business (e.g., experienced team, huge market, differentiated technology), to establish and maintain investor interest.

6. Schedule a Pitch Session

Schedule pitch sessions with investors who express interest. Be ready to send your executive summary and/or pitch deck beforehand. Also be ready to send additional supporting information (e.g., market analysis, financial projections) as requested.

- Send your pitch documents as PDF attachments or links (using a service like DocSend)

- Use email or social media (e.g., LinkedIn) to deliver the documents

- Set up an in-person or video meeting, using Google Meet, Zoom, Teams or similar product

Obviously, you should practice your pitch before presenting it. You should also practice answering questions. This is not the time to improvise your pitch.

Remember, you’re asking for funding. So, you need to be respectful of the investors and not waste their time.

Be confident and professional. Also, don't be afraid to ask for feedback or recommendations.

7. Conduct your pitch

Pitch your startup to the investors clearly, concisely and coherently. Be ready to answer questions about any of the pitch topics.

You should be prepared to explain your startup, the value proposition and your plans for growth, as you will likely get questions related to these points. Show that you’ve done your homework.

- Pitch to the investor’s thesis, as this will resonate with the investor

- Make a compelling case about why the investor should fund your startup

- Highlight risks and your mitigation approaches, as appropriate

- Be clear on your funding request (e.g., how much, when needed, how applied)

Schedule follow-up meetings as needed. Provide whatever additional answers or information the investors need to help make funding decisions.

Remember to ask for feedback or recommendations. If it makes sense, also ask for a referral to anyone else who may help you on your startup journey.

8. Provide Requested Material

Offer to provide follow-up answers and information as requested.

- Create a data room for your startup documents

- Include your pitch documents

- Include related material, such as financial, market research and intellectual property

- Provide any insight to help an investor write a deal memo (formal or informal)

- Describe the risks and rewards of funding your startup

- Describe worst case and best case scenarios, if appropriate

Maintain positive relationships with investors and be transparent about your business progress. An investor who says no after your pitch might be interested in future, based on your continued progress.

Even if the answer is an absolute no, be respectful and professional. You don’t want the word to spread in the startup community that you are a difficult founder.

Accept the reality that you will hear “no” several times before getting a “yes.” This is part of the journey.

9. Negotiate a deal

The discussion about whether or not the investor will write you a check can occur during or after your pitch. If the investor is interested, discuss what the next steps will be.

Ask for the amount of funding you need but be willing to compromise. Investors may want to negotiate equity and terms. So, you should be clear on what you are willing to offer in return for their investment.

Corporate investors who write large checks may want to actively participate in your startup operations, and may ask for board seats.

- Review and revise your valuation as appropriate

- Explain the relationship between your valuation and your funding request

- Explain when you need the funds and when the round will close

- Also explain how you will use the funds (e.g., marketing, development)

It's important to be transparent about your financials and your startup's valuation. Attempts to mask the truth about your startup will eventually be exposed during the investor’s due diligence.

The negotiations may take some time, especially if there is much due diligence. So, be patient.

Once everyone agrees on the terms and conditions, finalize the deal by signing the legal documents (e.g., SAFE, term sheet) and providing transfer instructions.

Maintain a good working relationship with your investors, as they can provide valuable advice and guidance as your business grows.

Rinse and Repeat

Repeat the steps in the process as often as needed to pitch investors and obtain funding. Be persistent in your efforts, as it may take several contacts.