One of the most crucial steps in your startup journey is to develop a winning pitch deck that will capture investor attention. Though every startup is unique, there are core topics that investors expect to see in any successful pitch.

Crafting a winning pitch deck can be challenging, but you can increase your odds of success by understanding what investors are looking for and tailoring your presentation to their needs. Addressing the right topics in your pitch deck can make all the difference in convincing investors to fund your startup.

Whether you’re a first-time founder or a seasoned entrepreneur, this article will provide the insights you need to create a compelling pitch deck that will help you secure the funding to grow your business.

But how do you create a successful pitch for your startup?

- What key topics do investors want you to address?

- What important questions do they tend to ask?

- What related information do they want to know?

You may have already spent hours or days searching for the perfect pitch deck template with just the right topics and the appropriate number of slides. You should stop looking.

There is no consensus on the right set of topics. Different sources will specify different sets of topics, though with some overlap. But there are 10 core topics which are considered most common.

There is also no consensus on the minimum or maximum number of slides. Use whatever number of slides you need to tell your startup story. The range of 10-20 slides is common, depending on how far along you are in your startup journey.

Tip: You can use these 10 core topics to create all your pitch documents: pitch decks, elevator pitches and executive summaries.

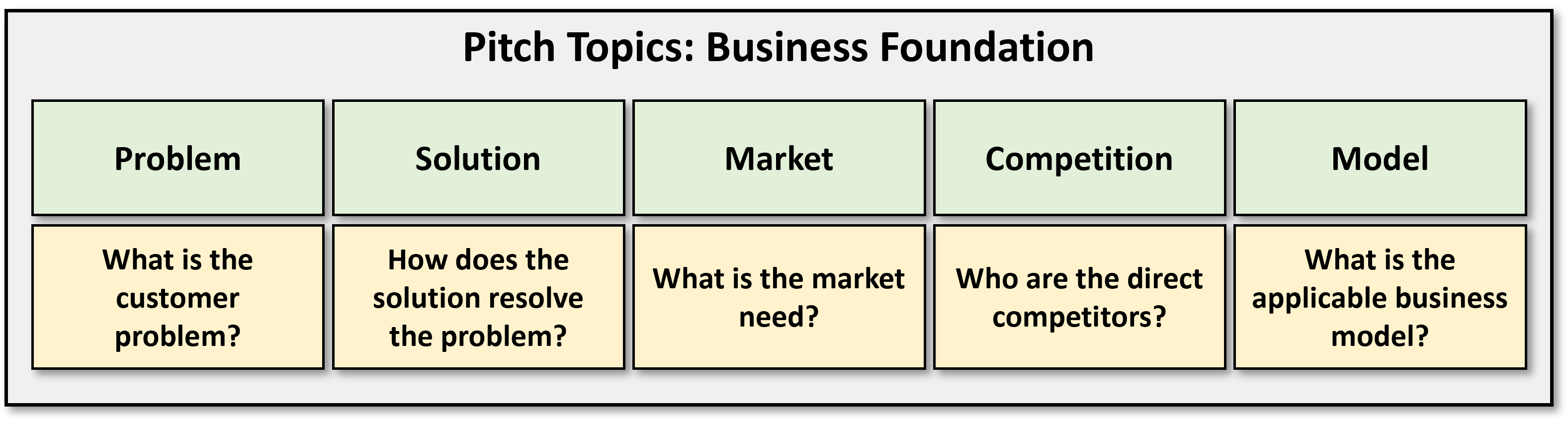

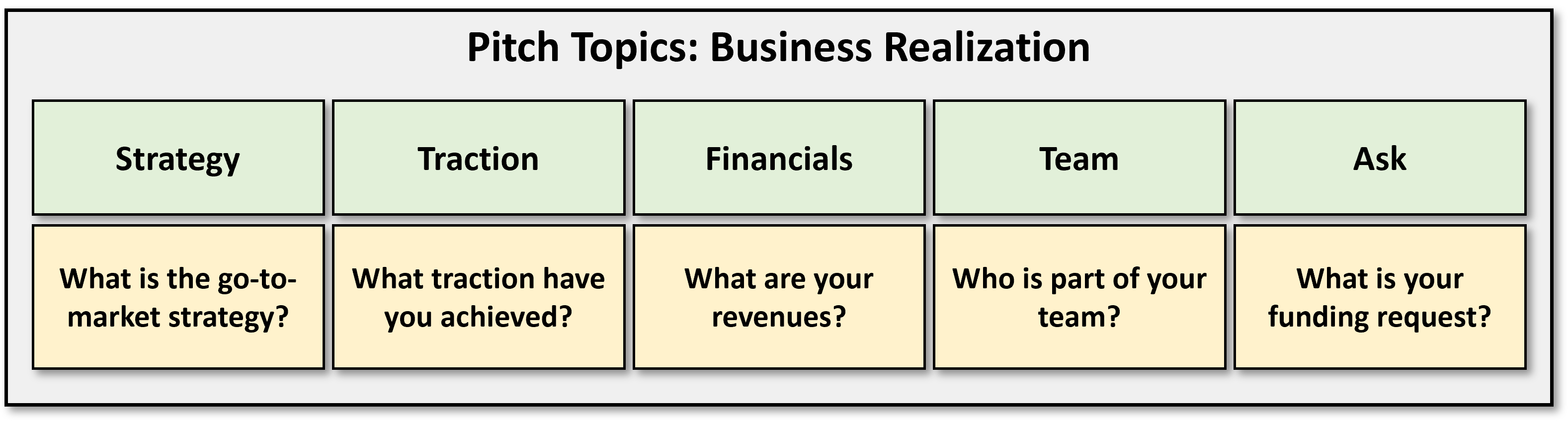

The 10 topics are divided into two sections: Business Foundation and Business Realization.

The five business foundation topics and associated key questions represent the basis on which startups are formed.

The five business realization topics and associated key questions represent what is required to make the foundation a reality.

Here are the 10 core topics of a winning pitch.

1. Developing Your Problem Statement

The problem slide is one of the most critical slides in a pitch deck. If you don’t nail the problem clearly and concisely, the rest of the deck is almost meaningless.

Unfortunately, many founders struggle with this slide. They tend to present a problem that is:

- Overly vague, which makes it hard to understand

- Too broad in scope, which would be too complex to solve

- Part of a multi-problem set, making it difficult to discern what’s most important

Sometimes founders breeze past the problem because they want to quickly focus on the solution. And sometimes the solution doesn't even fit the problem, so there’s no problem-solution fit.

Here’s a more effective way to describe the problem you’re trying to solve.

- Identify the customers

- It may be helpful to establish customer personas to clarify who they are

- Explain the problem that customers are struggling with

- Describe the scope of the problem

- Is this a major problem customers can’t overcome on their own?

- Or is this a minor problem that customers can live with?

- Describe the pain points and how they are affecting customers’ lives or businesses

- Document any relevant data and statistics from your market research

The problem slide establishes the need for your solution. It also gives meaning to the rest of the deck.

You should spend the time and effort to develop and refine the problem, because it is so critical. Perhaps, show it to people you trust for their reactions.

2. Describing Your Solution

Once you’ve nailed the problem, you can focus on the solution. As mentioned above, you want to be sure your solution matches the problem.

Use this approach to present your solution:

- Describe what the solution (product or service) is

- Describe how it works (features)

- Describe how it integrates with existing customer systems and products (mainly for B2B)

- Describe the benefits to the customer

Note that investors prefer to learn about a unique or innovative solution, ideally one that cannot be easily replicated by the competition.

3. Explaining Your Market

This is another critical slide for highlighting the current and potential market for your startup.

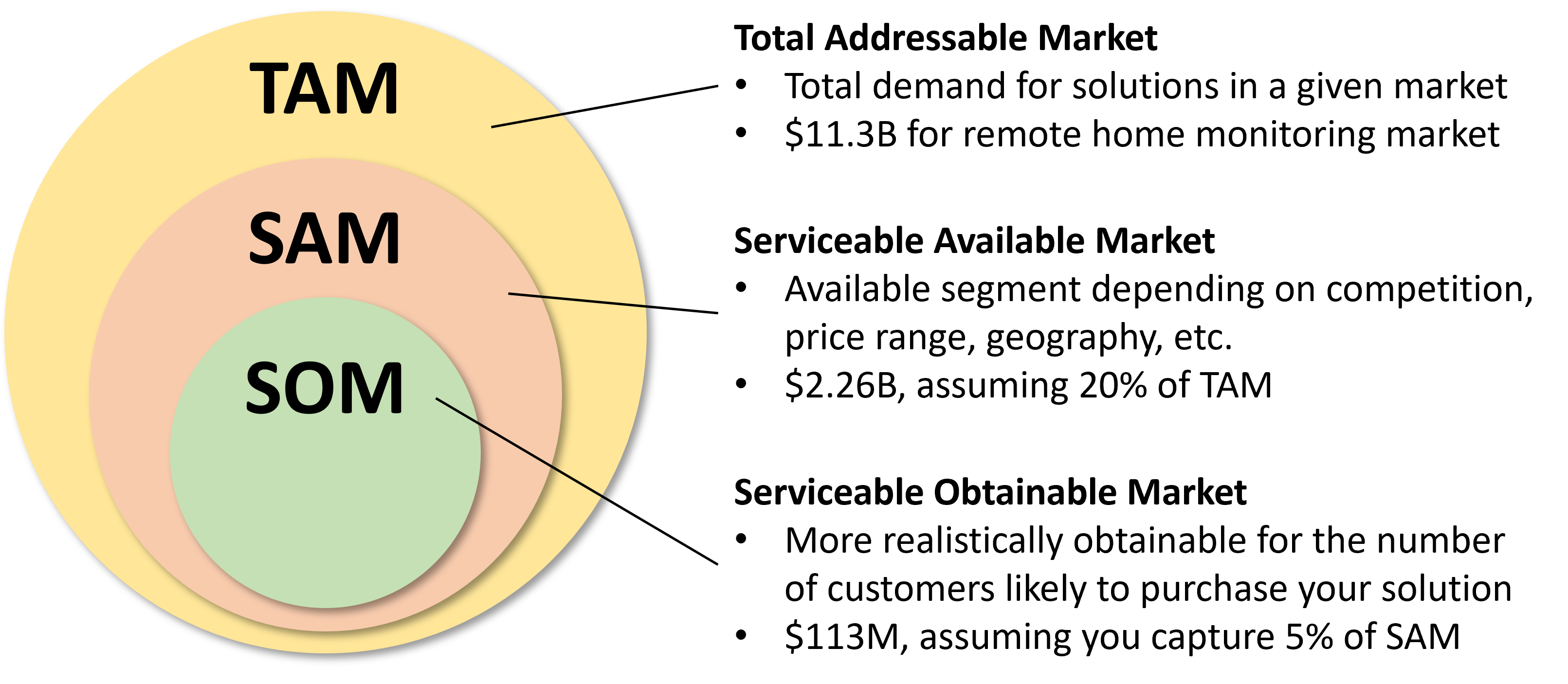

You will need to show that the market is relatively large with huge growth potential to get attention from investors. You’ll also need to present this data in terms of the addressable, available and obtainable market sizes.

Use this approach to determine your market.

- Clarify the sector and industry for your business

- Conduct industry research to determine the overall market

- Analyze market trends and growth projections

- Analyze data from recent and projected sales

- Use these results to determine your market sizes

As an example, let’s say you want to sell software for the remote patient monitoring market. Let’s also say you want to sell your software in the $250 to $750 price range to the east coast market.

According to the Industry Outlook and Forecast 2022-2027 from market research firm, Arizton (www.arizton.com), the US market was valued at $11.31B.

These results represent the portion of the overall market you are likely able to capture with your solution.

This chart presents an effective way to present market sizes. But you can use any graphical or tabular format that conveys the information clearly and concisely.

4. Differentiating from Your Competition

The competition slide should demonstrate that you understand the competitive landscape and you know how to position your startup in the market. You should also be able to explain your competitive advantages and any barriers to entry.

Tip: There is always competition, so don’t claim you don’t have any. This gives the perception that you are either too egotistical or you haven’t done your homework.

- Identify your direct competitors

- Describe your competitors’ strengths and weaknesses

- Describe how your solution is unique or different

- Describe how you will compete and win in the market

- Explain your growth potential compared to the competition

Investors want to see evidence that you have conducted your research and have a solid understanding of the competitors, as well as the customers and markets.

5. Establishing Your Business Model

Investors want to see that the startup has a clear and sustainable business model that can generate revenue and profit. The business model slide should include a detailed explanation of the startup's revenue model, pricing strategy, and target market.

Investors want to understand how your business will generate revenue, how much it will cost to acquire customers, and what your margins will be. You need to be able to explain how you will scale your business and what your growth projections are. Investors will be looking for a clear and well-articulated plan for how you will make money.

- Explain how your startup will generate revenue

- Explain your focus on business or consumer markets (B2B or B2C)

- Highlight the potential revenue streams

- Describe the pricing model for your solution

- Describe potential opportunities for growth/scale

Investors want to see a solid plan for generating revenue and growing the startup.

6. Outlining your Go-to-Market Strategy

Investors want to see that the startup has a clear and effective plan for reaching its target market and generating revenue. The go-to-market strategy slide should include a detailed explanation of the target market and the key distribution channels, as well as the sales and marketing strategy.

Investors want to understand how you plan to reach your target market and what your customer acquisition strategy is. You should be able to explain your marketing channels and tactics, as well as any partnerships you have in place. Investors will be looking for a clear and well-thought-out plan for how you will acquire and retain customers.

- Explain your marketing and sales strategy to reach your target market

- Describe your approach to acquire and retain customers

- Describe your revenue and distribution channels

- Discuss potential partnerships with other organizations

- Highlight your key metrics or goals and your process for measuring them

- Describe how you will resolve risks or roadblocks to executing your strategy

Investors want to see that you know how to reach customers and generate revenue. They also want to see that you understand the potential challenges and risks associated with executing your strategy.

7. Building Traction

Traction is about providing evidence that your startup has a market of customers. It is proof that customers are willing to spend money on your solutions.

Investors prefer to see that you have already achieved some traction, as it validates your solution and your market.

The best way to show traction is to highlight the track the type of metrics that interest investors.

- User metrics, such as the number of users willing to use or test your solutions

- Customer metrics, such as the number of customers, letters of intent and paid pilots

- Revenue metrics, such as sales, monthly or annual recurring revenue

- Growth rates in customers, revenue and cash flow

- Media mentions, customer testimonials and partnership statements

- Related metrics, such as average revenue per customer and customer acquisition cost

You may also want to describe how you will gain additional traction. Additionally, you may want to highlight how you plan to mitigate any risks to accomplishing your levels of traction.

A few points to consider.

Don’t worry if you don’t have any traction yet. Many founders have been successful at pitching their pre-traction startups to investors who provide early (pre-seed) funding.

Your limited traction is another reason you should work on pitching a compelling story about your startup to investors.

Don’t waste time on vanity metrics, such as the number of likes or shares. These metrics can certainly help to build buzz about your startup, but they are not the same as getting customers and sales.

You essentially need to show investors you’ve achieved some traction in your business. And you need to demonstrate you’re already making progress on a path towards growth.

8. Presenting Your Financials

Investors want to see an accurate presentation of a startup's financial performance, along with realistic and well-supported financial projections.

Investors prefer to see steadily increasing customer and revenue growth, so you should be prepared to explain any dips. They also want to see your revenue as a foundation for sustainable growth and a clear path to profitability.

You should be able to present the details on your current and projected financials.

- Show current sales, revenues, expenses and cash flows

- Show financial projections over the next 3-5 years

- Outline the basis and assumptions for your projections

- Outline any risks that may impact performance

- Describe how you manage cash flow

This type of detail helps to build credibility with potential investors and increases your chances of securing funding.

Tip: Don’t get carried away with overly optimistic financial projections, with little or no substantiation. Don’t pretend to be a billion-dollar business if you can’t clearly explain how you will get to that level. Experienced investors won’t believe your exaggerations and will lose interest in your startup.

You’ll get more attention with financials that make sense and are easily explained.

Remember that investors will offer funding only if they believe you have the potential to generate a good return. Be as transparent as possible with your financials and focus on your plan for growth.

9. Highlighting Your Team

Investors want to know who is behind your startup and what experience you have. You need to demonstrate that you have a strong and capable team that can execute according to your pitch deck.

You should highlight any relevant experience, especially if you’ve had past successes in similar industries. Investors want a team that can execute the required operations and navigate any challenges that arise.

- Highlight your founder(s) with relevant experience and successes

- Highlight any key staff you’ve hired

- Highlight your advisors

- Include your board of directors, if applicable

- Include any partners, such as manufacturers or suppliers, if applicable

I remember an interview from years ago with Barbara Cochran, of Shark Tank fame, who said that while the other sharks are peppering the founders with financial questions, she’s paying attention to the founders’ behavior.

Barbara wants to see how much passion the candidates have for their product, how they handle questions and whether they seem willing to do whatever it takes to have a successful business. She said she prefers to bet on the jockey (founder), not on the horse (business), a sentiment echoed by many investors.

Clearly, your team is one of the most critical topics you can address in your pitch. A team with relevant technical and business experience, ideally with prior successes, will get favorable attention from investors and more likely encourage them to write checks.

10. Requesting Investment Funds

Now we’re at the slide that’s most important to getting investor funding. This is the culmination of everything you’ve presented so far.

You’ve described your startup’s value to the market and you’ve told a compelling story about your customers and your business. Now you’re ready to ask for funding.

You should provide a clear and compelling explanation of your funding needs, and a plan for how you will use the funding to grow your business.

By demonstrating a strong understanding of your financial needs, plans and growth goals, you can increase your chances of securing funding from investors.

- Explain how much funding you need

- Explain your startup valuation

- Explain the basis of your funding request

- Highlight your monthly burn rate

- Highlight your runway (months remaining at current burn rate)

- Highlight any prior amounts and sources of funding

- Describe how the new funds will be used

Investors will be looking for a clear and well-articulated plan for how you will grow the startup and generate a return on their investment. You may need to reiterate your growth strategy as well as your exit strategy, whether it's through an acquisition or Initial Public Offering (IPO).

Once an investor has committed to funding your startup, you will need to discuss the funding instrument (Simple Agreement for Future Equity (SAFE), convertible note or equity), along with terms such as the valuation cap or discount rate. The details are beyond the scope of this article and will be included in a future article.

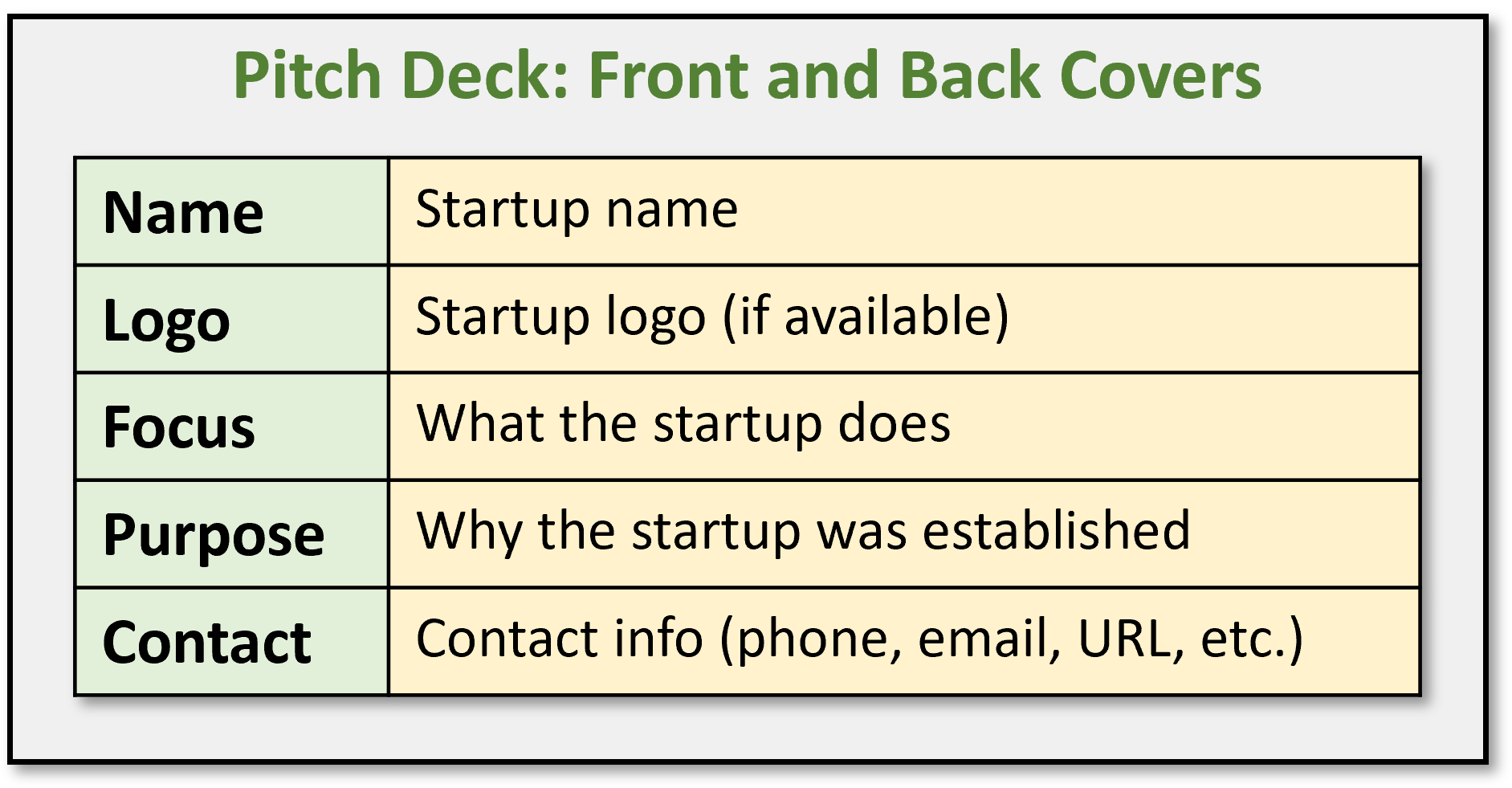

11. Bonus: Front and Back Covers

Founders generally pay little attention to the front and back covers of their pitch decks. Besides including the startup’s name and logo, and maybe a relevant graphic, the covers aren’t really treated as part of the pitch.

Consider that your front cover may be up for a few seconds or minutes during the introductions. Why not take advantage of the opportunity to get the investors to begin thinking about your startup.

Think of the cover as your hook to get investor attention. You can add a few words about your business focus and purpose, to highlight what your startup does and why you started it.

Per the example in the Explaining the Market section above, you could state your focus is to:

“Sell software to the remote patient monitoring market”

And your purpose is to:

“Empower families to manage and improve their health”

Alternatively, you could use your tagline if you have one.

Highlighting your startup focus and purpose on the front cover is especially important if you only have about five minutes to pitch. Investors will already know something about your startup, and perhaps be intrigued by your hook, before you even begin.

Naturally, you may repeat or rephrase your cover statements during the pitch, but this will help to reinforce your message.

You should repeat the front cover information on the back cover to keep your startup top of mind, if there is a question-and-answer period. You should also include your contact information so that investors, and their referrals, can follow-up with you to discuss if they are interested.

Conclusion

There you have it. The 10 most common topics to include in your pitch deck.

You don’t have to use the exact topic names as your slide titles, as long as the content clearly addresses the topic.

Also, keep your slide count in the most common range of 10-20 slides. Too few slides won’t provide enough information to investors and too many slides will drown them in details.

Of course, you may need to tailor your pitch deck based on any investor feedback you may have received. You may also need to tailor the deck depending on your business stage, funding round or level of traction.