Attracting investors can be a challenging and daunting process for founders, and there are some common hurdles that make it more difficult. However, with the right approach and mindset, you will be able to overcome these hurdles.

There are seven most common hurdles to attracting investors, compiled from research including CB Insights (https://www.cbinsights.com/) and Entrepreneur Magazine (https://www.entrepreneur.com/). See the research links below.

1. Unclear Customer Problem

I have lost count of the number of times that founders have struggled to clarify the problem during a pitch. Being able to communicate the problem clearly and concisely is the foundation for any pitch.

You will quickly lose investors if your problem description is too broad, too vague or too complex. You’re essentially saying that you haven’t done your homework. You may also be saying that you’ve already decided on the solution and you’re trying to force fit a problem that matches.

It is important to be able to communicate your problem-solution fit. And to do so, you must have a well-defined problem.

Here are the key actions to defining your problem:

- Research your market to identify the problem you want to resolve

- Identify the customers with this problem (highlight unique personas as applicable)

- Describe the scope of the problem (the bigger the better)

- Is it a gorilla-size problem that the customer must resolve now?

- Is it a chimpanzee-size problem that the customer should resolve soon?

- Is it a marmoset-size problem that the customer could ignore for the time being?

- Describe the related customer pain points and impact

Note: I expanded on the gorilla-chimpanzee metaphor I learned from Meade Sutterfield, an experienced and highly regarded VC in Atlanta, GA.

2. Undefined Market Need

Investors want to see that you have a clear understanding of your target market, including the size, growth potential and competition. You should be thorough in your research to develop a deep understanding of your target market.

- Determine the market sizes relevant to your startup

- Total Addressable Market (TAM)

- Serviceable Addressable Market (SAM)

- Serviceable Obtainable Market (SOM)

- Validate the market by soliciting feedback (similar to validating the problem)

- Highlight the growth opportunities in the market

Investors want to see a compelling market need. They want to see that you’ve done your homework and are prepared to explain the need, customer demand and growth potential.

3. Non-Viable Business Model

Your business model describes how you will generate revenue, and consequently how the investors will make money. So, you need to have a model that is sustainable and can generate revenue and profit consistently.

Be sure to select a business model that is most applicable to your startup. The best business model depends on your solution, industry, customers and target market.

Give this some careful thought since changing business models after you’ve launched your business can impact marketing and sales.

Here are some common business models to consider.

- Subscription. Businesses that offer access to a product (e.g., software application) or service (e.g., streaming service) to customers who pay a recurring fee.

- E-commerce. Businesses that provide products or services directly to customers via an online environment, such as an e-commerce website or social media account (think Amazon or Walmart).

- Platform-based. Businesses that create a platform (marketplace) that connects providers and customers and facilitates the transactions between them (think Uber or Airbnb).

- Brick-and-mortar. Businesses that establish a physical store to sell products or services (for example, restaurants or health spas).

- Licensing. Businesses that license their technologies or intellectual properties to other businesses, which in turn create their own products.

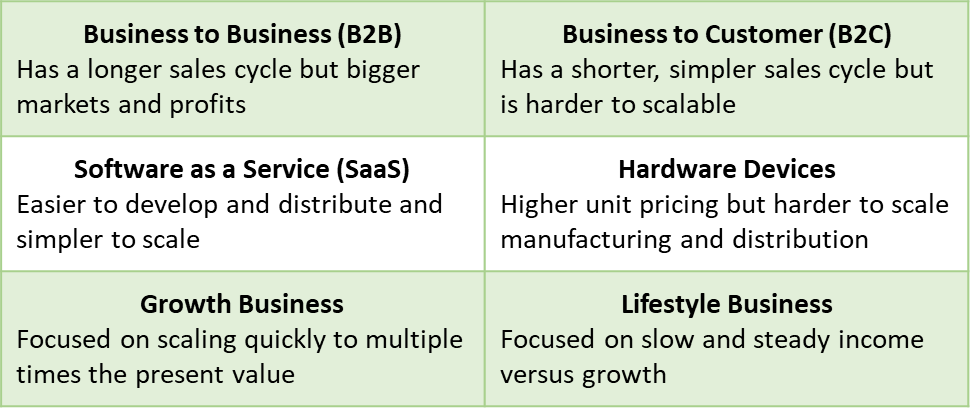

Additionally, consider some of the related business comparisons that investors evaluate in terms of their growth potential. Investors use these comparisons to make funding decisions based on which options offer higher levels of scalability that would lead to bigger returns.

Here are some common business comparisons.

There is no right or wrong business model or option. But you are likely to attract more investors if your startup aligns with the more commonly used models and the higher scalability options.

This is particularly attractive to investors who prefer growth-oriented opportunities with higher returns.

4. No Competitive Differentiation

There is not much point in launching a new startup if you can’t differentiate your business from the competition. You must be able to show how your solution is unique.

Some founders like to claim there is no competition, but this is wishful thinking. Unless your solution is especially unique, assume there is competition, and take the time to find out.

You may want to claim that you offer a better or faster solution, but this is too vague to get any attention. Such an offer may sound good in theory, but it is not compelling.

Instead, you should explain your solution in terms of the unique features and, more importantly, the unique benefits to your customers.

Tip: Don’t launch your startup with the intent to be the cheapest solution. This often induces a race to the bottom as competitors try to outdo each other with ever lower pricing.

Do your research to determine how much competition already exists, and how you will position your startup in the market accordingly.

- Identify the competitors and their current products

- Analyze their products’ strengths and weaknesses

- Highlight your product benefits in terms of customer value

- Develop a comparison table or chart that emphasizes your product’s uniqueness

Pay special attention to whether any of your competitors has a moat, such as proprietary techniques or technologies, that gives it a competitive advantage. Competitive moats are naturally more difficult and/or expensive to overcome.

Also, if a competitor has an entrenched customer base, it may be more challenging for your startup to carve out a share of the market.

5. Inability to Achieve Traction

Investors prefer that you have a solution that customers actually want. They want to see that you have been making progress towards business milestones, such as a specific number of customers or volume of sales. They want to see traction.

You must be able to get your solution in front of customers (marketing) and customers must be willing to buy (sales).

Without customers, your startup may very well be just a hobby. And investors will be less likely to invest.

You need to establish metrics that you can use to measure traction.

- Identify metrics applicable to your startup

- Track your business performance to the metrics

- Adjust your metrics as needed based on performance

- Preferably, adjust your marketing, sales or operations to ensure performance

If you’re in the pre-traction stage, meaning you don’t yet have customers or sales, you can still show traction. You could highlight the number of users evaluating or testing your solution (e.g., beta testers). Or you could highlight the number of letters of intent from potential customers.

Tip. Pilots are good mechanisms to help customers commit to evaluating your solution, perhaps as a partial rollout. Though I do not recommend free pilots, due to the amount of time and effort required to support them.

6. Poor Financial Management

Many of us don’t balance our checkbooks anymore. We don’t even write checks.

We sometimes glance at our bank account statements just to be sure our finances are as expected and that there are no unpleasant surprises. We generally trust the banks to keep track of the inflows and outflows, and to do the math correctly.

Maybe we shouldn’t be so trusting but that’s a different topic for a different day.

With the ever-expanding use of online banking, the mechanics of money management has become even simpler. When it comes to your startup however, this simplicity does not preclude the need to pay strict attention to revenues and expenses.

If you are not effective in managing your business finances, you run the risk of losing control of the business.

- Create a financial plan, including goals, budget and spending plan

- Track the funding you’ve raised and expended

- Track customers and revenues (using categories that are most applicable)

- Create financial tables or charts to share with investors as appropriate

Understand that investors want to see that you have a solid financial plan and can manage revenues and expenses. Anything that seems odd or questionable or hard to explain will make investors hesitant to invest.

7. Limited Team Experience

Investors look for a strong team with the relevant expertise to build and operate the startup. This includes the industry knowledge needed to conceive the problem and solution, and the technical skills to develop the solution (at least the initial version).

It is unusual for a founder to have both industry and technical expertise, which is why investors prefer two cofounders. Not only can cofounders split the workload, but they can support each other, especially during challenging times.

Ideally, you should have a team with a track record of success with other startups or established companies.

- Establish the startup with one or two founders

- Emphasize the relevant industry and technical expertise

- Highlight the relevant expertise of any key hires

- Highlight the relevant expertise of any advisors

Investors consider the team to be a critical element, if not the most critical element, in building and operating a successful startup. So, you should not decide on team members and advisors simply based on existing relationships. Everyone associated with the startup must have the relevant expertise.

Conclusion

These are the most common and most challenging hurdles for startups, or any business for that matter. But you can overcome these hurdles by being diligent in following the above steps.

Develop a strong business strategy or plan, conduct thorough market research, validate the market need, demonstrate traction, manage your finances and build an experienced team.

By addressing these common hurdles, you can improve your chances of attracting investors and building a successful startup.

Research Links

https://www.cbinsights.com/research/report/startup-failure-reasons-top/