As a startup founder, you should adopt a set of principles to guide your interactions with investors. This is especially important when you’re making pitches and raising funds.

It’s tough enough to commit the time and effort on the steps to attract and pitch investors. Only to miss out because of some action that was inconsistent with the principles.

You will certainly make mistakes during your startup journey. This is expected.

But you don’t want to compromise all your hard work by making unforced errors that can easily be corrected.

Here are 10 of the top do’s and don’ts, with respect to pitching investors.

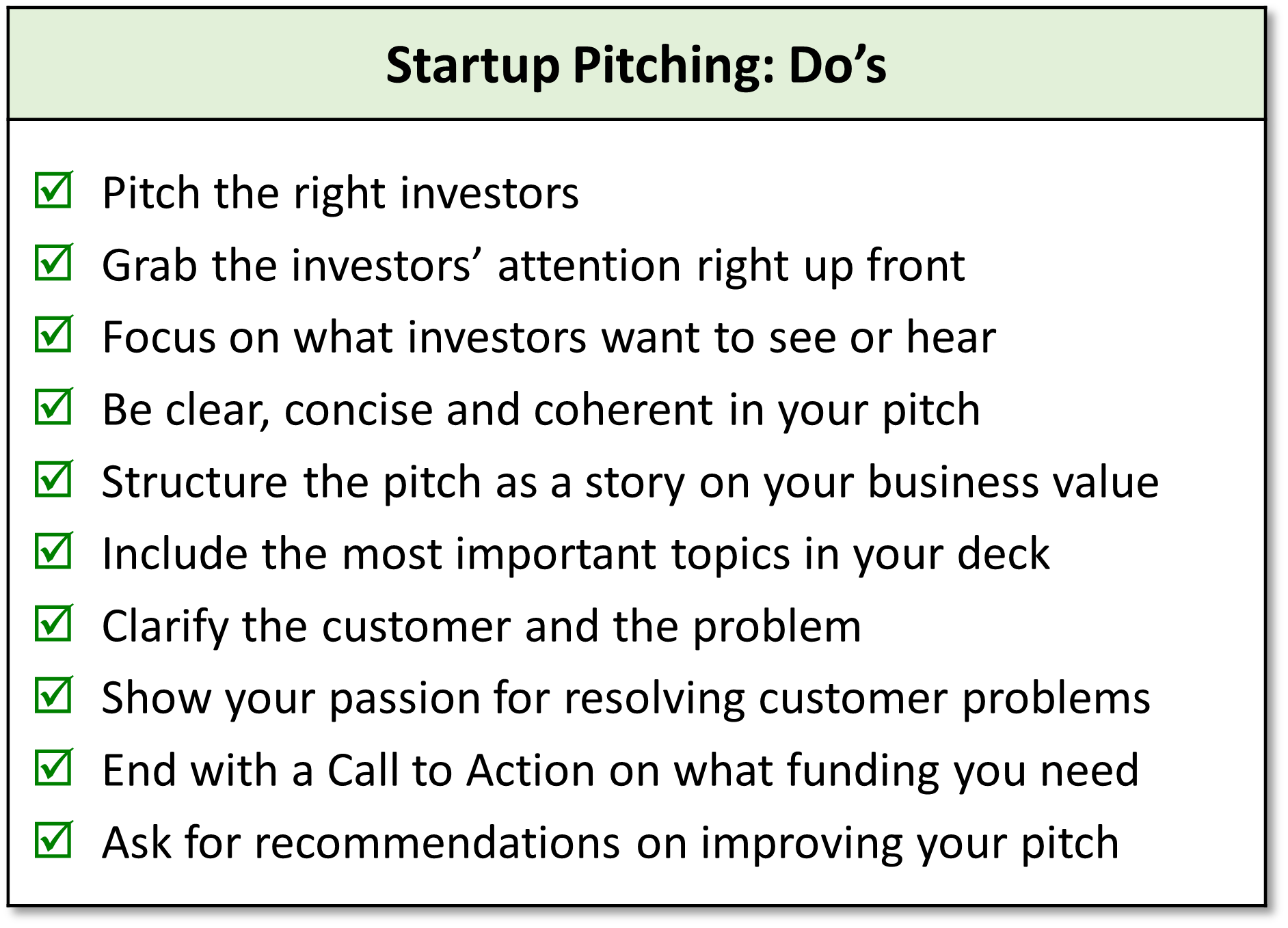

Top 10 Do’s

So many founders struggle with pitching because they don’t understand how to engage the investors and keep their interest level high.

1. Pitch the right investors

- Leverage the startup ecosystem to find investors

- Pitch to those whose theses align with your business

2. Grab the investors’ attention right up front

- Use the front cover to prime the investors on what your business does and why

- Use this slide to help you lead into your pitch story

3. Focus on what investors want to see or hear

- Remember, this is not about you; it’s about the investors

- Think about what investors want to know and pitch accordingly

4. Be clear, concise and coherent in your pitch

- Focus on what’s most important so investors don’t get overwhelmed or confused

- Practice your pitch to eliminate superfluous details and ensure smooth delivery

5. Structure the pitch as a story on your business value

- Include a use case on who your customers are and how they will benefit

- Highlight how your business will change customer behavior

6. Include the most important topics in your deck

- Address the key topics using whatever titles or headings make sense

- Be sure the content matches the topic

7. Clarify the customer and the problem

- Explain what the problem is and how it impacts your customer

- Explain how your solution resolves the problem directly (problem-solution fit)

8. Show your passion for resolving customer problems

- Tell your story and show your passion to help get investors engaged

- Also show why resolving customer problems is so important to you

9. End with a Call to Action on what funding you need

- Explain your funding plan and how you will use the funds

- Also ask for referrals to other investors, if appropriate

10. Ask for recommendations on improving your pitch

- Ask for feedback on your deck, as investors are generally candid

- Also ask for feedback on your narrative

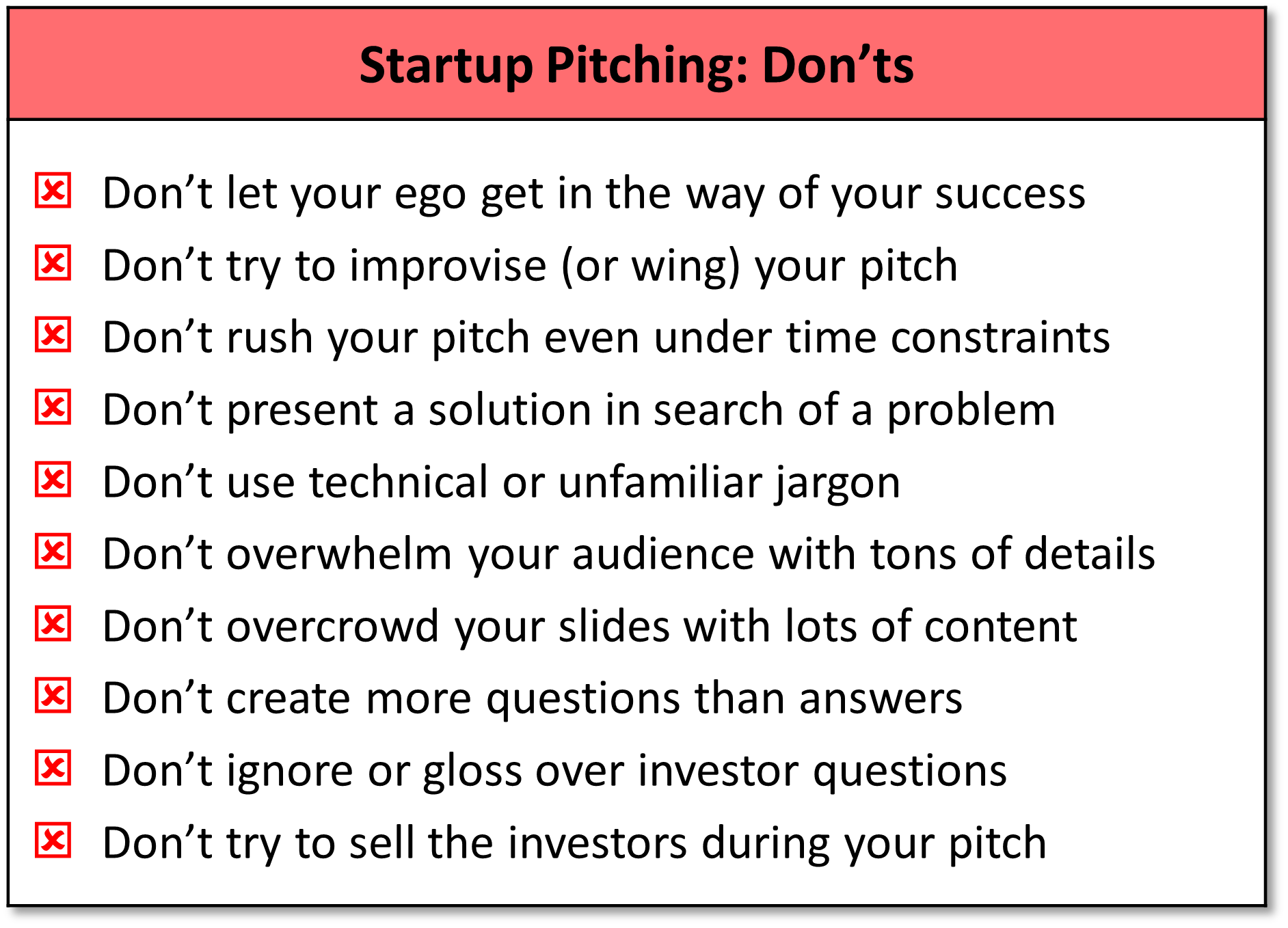

Top 10 Don’ts

You should do your best to avoid these mistakes. They can negatively impact your ability to raise funds.

1. Don’t let your ego get in the way of your success

- Don’t let your attitude interfere with your ability to engage the audience

- Pitch to obtain funding not to show off your brilliance

2. Don’t try to improvise (or wing) your pitch

- Don’t try to make it up as you go; your lack of preparation will become evident

- Avoid wasting your time and the investors’ time

3. Don’t rush your pitch even under time constraints

- Tailor your pitch to the amount of time you have available

- Focus on covering a few topics well than a lot of topics poorly

4. Don’t present a solution in search of a problem

- Don’t get overly enamored with your solution

- Explain how the solution resolves the problem and how the customer benefits

5. Don’t use technical or unfamiliar jargon

- Don’t assume your audience knows much about your industry

- Avoid turning your pitch into a technical presentation; you’re there to raise funds

6. Don’t overwhelm your audience with tons of details

- Don’t lose your audience in the weeds; remember why you’re there

- Don’t present too many details; you risk losing your audience

7. Don’t overcrowd your slides with lots of content

- Avoid slides packed with small or hard to read fonts

- Avoid dense images that can’t be quickly processed

8. Don’t create more questions than answers

- Avoid presenting information that can’t be easily understood

- Don’t take too long explaining concepts or topics

9. Don’t ignore or gloss over investor questions

- Pay attention to investor questions; it shows a level of interest

- Be prepared and thoughtful about your answers

10. Don’t try to sell the investors during your pitch

- Avoid the hard sell; investors are there to invest not to buy

- Focus on how your startup provides value to customers and investors

Conclusion

This set of do’s and don’ts is not meant to be exhaustive. However, they do represent the most common principles founders should adopt and the most common mistakes founders should avoid.